Delhivery aims for pre-IPO funding at $3 billion valuation – Times of India

[ad_1]

Read More/Less

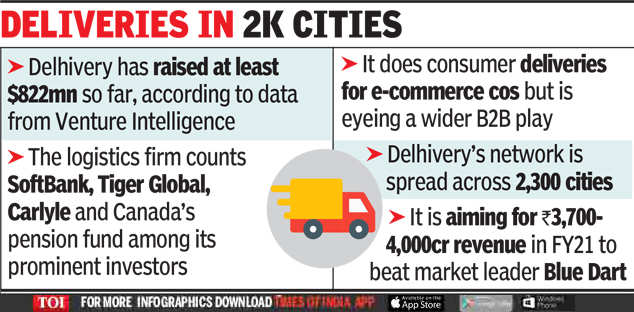

This indicates an almost 50% higher valuation for the SoftBank-backed Delhivery in about three months, if a deal is concluded. The pre-IPO round is said to be in the range of $100-150 million, but it could change based on discussions. This would also include a smaller secondary share sale.

In a secondary transaction, existing investors sell their stake (partial or full) to new investors and the money does not go into the company coffers.

The e-commerce-focused logistics firm is one of the leading contenders for an IPO among the top league of Indian startups.

Others include Policybazaar and Zomato, both of which have also seen similar pre-IPO transactions recently with significant jumps in their valuations. This also marks the increasing global investor interest in large Indian startups who are seen as serious contenders to go for an IPO, which could result in good returns on the investment once the company goes public.

“This will be the last fund-raise before they go for an IPO. Fidelity is in active discussions with Delhivery and there is interest from other global investors also,” one of the people mentioned earlier said.

A spokesperson of Delhivery declined to comment on the matter. Fidelity said, “As a practice, we do not comment on individual companies.”

According to the last official statement from Delhivery in December 2020, it plans to go public in the “next 12-15 months”. Sources said it continues to work with audit firms for IPO preparedness. A recent report said it is in talks with several merchant bankers for its IPO.

Started in 2011, Delhivery gets the majority of its business from e-commerce deliveries but it has started expanding in the business-to-business (B2B) segment as well. It works across sectors like consumer electronics, fashion, FMCG, and select industrial sectors like auto.

Currently, e-commerce deliveries constitute around 65% of its total business but it aims to have equal contribution from both its e-commerce and B2B verticals.

Delhivery MD & CBO Sandeep Barasia had told TOI in October 2020 that the company will exit the current financial year with a revenue of Rs 3,700-4,000 crore, surpassing market leaders like Blue Dart. Other leading delivery companies include FedEx, Ecom Express, Gati and XpressBees.

According to media reports citing regulatory filings, Delhivery cut its losses significantly to around Rs 270 crore for the fiscal year ended March 2020, along with a 75% jump in revenue to nearly Rs 3,000 crore.

[ad_2]