A small part of the Indian workforce working from home could have a huge impact on commercial real estate and low-wage support jobs. But, on the other hand, high- and middle-income occupations are more likely to see bigger growth in a post-Covid job market, consultancy firm McKinsey says in a report.Remote offices, changing geography of workWork-from-home was the big change Covid brought to office routines across the world. Lockdowns showed that the scope for accomplishing work remotely was more widespread and feasible than previously thought.

And, businesses have been quick to embrace the opportunity.

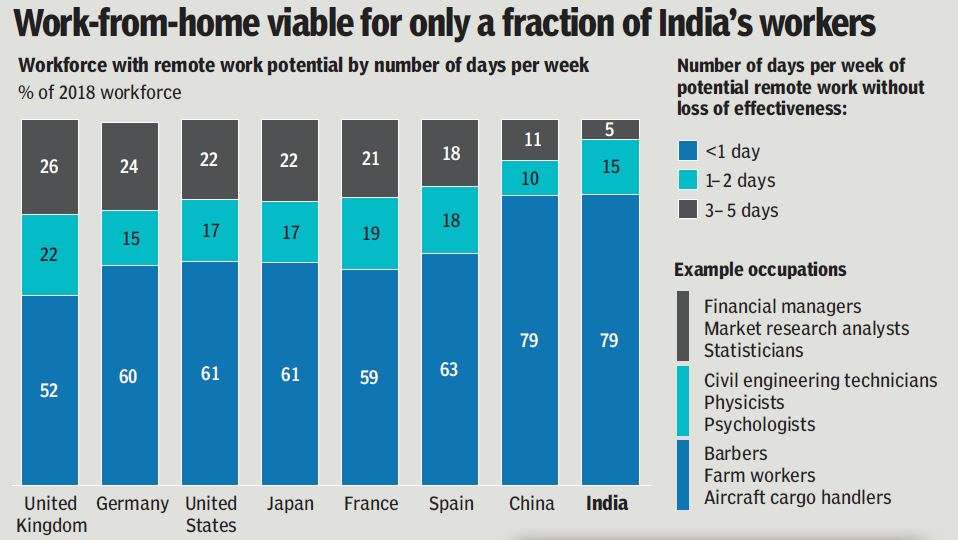

The report notes that some of the largest firms in India, like TCS and Infosys, have said they would continue with remote work after the pandemic. But the report adds that the “vast majority” of India’s workforce of 464 million is employed in jobs that cannot be done remotely – think agriculture and retail trade.

So, just 5% of the workforce can work remotely three to five days a week with no loss of productivity while an additional 15% could do so for one or two days a week, McKinsey said.

The knock-on impact of work-from-home for urban office districts could see footfall dipping at eateries and retail stores. Firms letting go of office space threatens maintenance and related staff. Remote work may also lead to a shift in the geography of work as workers move out of large cities.

Office rentals in Delhi-NCR, Mumbai, Bengaluru, Chennai, Pune, and Hyderabad fell to 13.7 million sq.ft in first half of 2020 against 32 million sq.ft in the same period in 2019.

Shopping at fingertips, stores out of sight

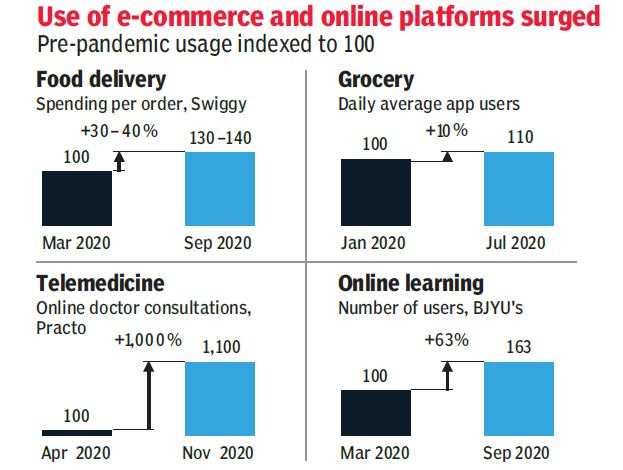

A clear shift in consumer behaviour has been the increased reliance on e-commerce platforms. Three-quarters of people who used digital channels for the first time during the pandemic said they would continue doing online shopping even when it’s back to business as usual.

Growth in online sales in India jumped two-fold

The growth of e-commerce sales, which more than doubled during the pandemic over the 2015-19 period, may amplify a shift to gig jobs as independent work lends the flexibility that many workers seek as they explore multiple earning avenues. However, gig work tends to be piecemeal with no clear roadmaps for growth and gig workers also lack paid sick leave and other benefits.

What it means for jobs

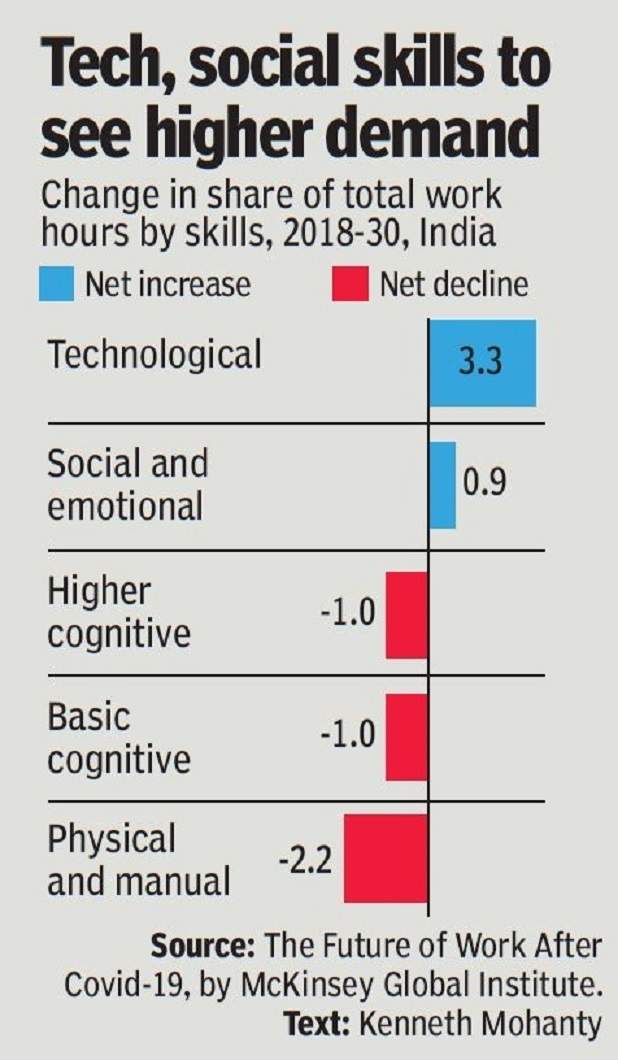

McKinsey says that one of the characteristics of a recession, which is what most economies are facing, is that firms look to cut costs by adopting greater automation and redesigning processes.

“Low-wage occupations may decline by 2030 for the first time… and the STEM professions continue to expand,” it added. As for India though, “its stage of demographic and economic development” would likely result in a smaller impact on jobs due to Covid-19 than in other major economies.

India’s growing labour force and population mean that almost all jobs will grow significantly. But more than 20 million workers may have to move out of agriculture by 2030.

Some growth in middle-wage jobs is estimated as the economy transitions away from agriculture. But post-Covid automation and e-commerce, although smaller than in other countries, may decrease jobs available into which farm workers can shift.

1.8 crore workers in India will need to transition into new jobs by 2030. McKinsey says that, due to the impact of Covid, up to 25% more workers in the economies analysed (US, China, Germany, Japan, UK, France, Spain, India) may need to switch occupations by 2030 than previously estimated.