New-age desi tech companies use crypto for pay, perks – Times of India

[ad_1]

Read More/Less

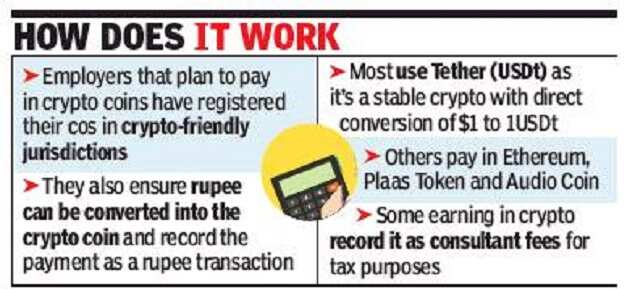

There are two approaches taken by employers. One is to register their entities in crypto-friendly nations and pay their employees in cryptocurrency to avoid any legal or tax hurdles.

The second is to record the payment as a rupee transaction in their books, but to facilitate the conversion of the rupee into cryptocurrency.

An executive from a gateway company, which facilitates payments for cryptocurrency through banking channels, said, “Generally, we use a stable coin/cryptocurrency like Tether (USDt) to pay salaries. Employees can cash them out immediately or hold on to them.” Since Tether is pegged to the dollar, a systems engineer with a pay package of $60,000 per annum will get 60,000 USDt.

In India, cryptocurrency continues to be a grey area and both employees and employers are worried about the tax implications. “After encashment of altcoins via cryptocurrency exchanges, I file that amount as income from consultant fee for tax returns,” said Sujeet Kumar, a Patna-based consultant for use cases of blockchain and cryptocurrency.

Kumar gets paid in altcoin like Ethereum, Plaas Token and Audio Coin, which he encashes through Indian cryptocurrency exchanges. “I usually convert the coins according to my need. Most of my clients are in the cryptocurrency market, thus making the transactions easier and faster. I have taken my last year’s bonus via cryptocurrency too.”

The CEO of a cryptocurrency news website said, “We follow a method where we pay salaries in cryptocurrency and draw a salary slip in rupee. This spares employees from any concerns if their salary slips are in crypto.”

Opinder Preet Singh, who heads a crypto hedge fund called Chain Assets Capital, said, “With too many legal regulations and lack of clarification on recognising cryptocurrency in India, we have registered our company in a crypto-friendly jurisdiction abroad. This allows us to pay salary, bonuses and incentives or spend money in India and also around the globe, especially for freelancers hired overseas.”

[ad_2]