FDI inflows rise 40% to $53 billion in April-December – Times of India

[ad_1]

Read More/Less

Net inflows were estimated to be 30% higher at $48.5 billion as repatriation or disinvestment in Indian ventures also went up by a third to $19.1 billion, data accessed from the Reserve Bank of India (RBI) showed.

“India remained the bright spot in an otherwise shadowy year for FDI, as global inflows plunged by 42% year-on-year in 2020 ($859 billion), the lowest level since the 1990s, according to UNCTAD’s ‘Investment Trends Monitor’ released on January 24. India clocked a 13% ($57 billion) year-on-year rise, the highest growth among countries, boosted by flows into the digital sector,” the RBI said in a monthly publication released last week.

Although the government is yet to release the sector- and country-specific details, it attributed the increase to steps taken by it.

“Measures taken by the government on the fronts of FDI policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country,” the commerce and industry ministry said in a statement.

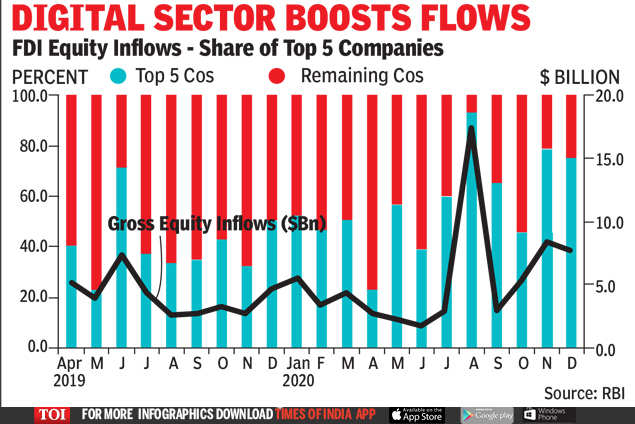

“Net FDI flows remained strong in December 2020, following a surge through August-November 2020… A surge in FDI equity inflows in August-December 2020 was largely driven by a few mega deals in digital services,” the RBI said in its monthly publication last week.

During December, FDI inflows are estimated to have increased 22.7% to $9.2 billion.

With sectors such as insurance all set to see an increase in the sectoral limit to 74% and several companies looking to diversify their production bases to reduce their dependence on China, the government is hoping that flows will remain strong.

The RBI, however, warned of possible downside risks to the outlook for FDI flows in 2021, citing the “persistent uncertainty clouding the course of the virus”.

Unlike inward flows, FDI outflows via investment by Indian companies dropped by almost a quarter during April-December 2020 to a shade under $8 billion, the RBI data showed.

[ad_2]