After lockdown washout, FY21 sees hit IPOs – Times of India

[ad_1]

Read More/Less

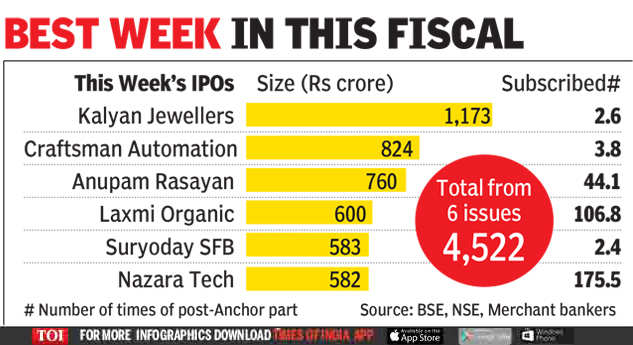

The week started with the closure of Anupam Rasayan’s Rs 760-crore IPO and Thursday saw the close of the Rs 1,173-crore IPO for Kalyan Jewellers, one of the leading organised retail jewellers in India. The hectic week ended with the Rs 582-crore offer for Nazara Technologies, the first Indian gaming company to go public, which closed with a subscription of over 107 times.

The week also saw listing of MTAR Technologies that nearly doubled on its first day on the bourses at Rs 1,082 compared to its IPO price of Rs 575. And on Friday, Easy Trip Planners listed at Rs 209, up 11% from its offer price of Rs 187, data on bourses showed.

So far in the current fiscal, the first three months till June, was a washout for public offers due to the nationwide lockdown that started in the last week of March. The Rs 497-crore Rossari Biotech in mid-July was the first IPO of the current fiscal, followed by the Rs 15,000-crore rights offer for Yes Bank.

According to Dharmesh Mehta, MD & CEO, DAM Capital Advisors, one of the leading merchant bankers in the public offering space, retail investors have been one of the driving forces for the IPOs in recent times. However, “one will have to lower the listing expectations and invest very selectively”, he said.

Mehta also sees a good IPO pipeline in the coming months. The market is expected to see record filings of IPOs in 2021 and large size offerings in the latter half of this year. “Investors have made huge returns in majority of the IPOs in the past six months and a bullish Indian market will help to raise record money in 2021 from capital markets.”

A large part of the Rs 4,522-crore that flowed into the market this week was from institutional investors, including foreign investors. And this foreign fund flow, to some extent, is supporting the strength of the rupee, market players said. The rupee is holding its ground around the 73-to-the-dollar mark despite the recent strength of the greenback. Support by the RBI is understood to be the main reason for this strength of the rupee, they said.

[ad_2]