Tesla names Musk ‘Technoking’ in cryptic regulatory filing

[ad_1]

Read More/Less

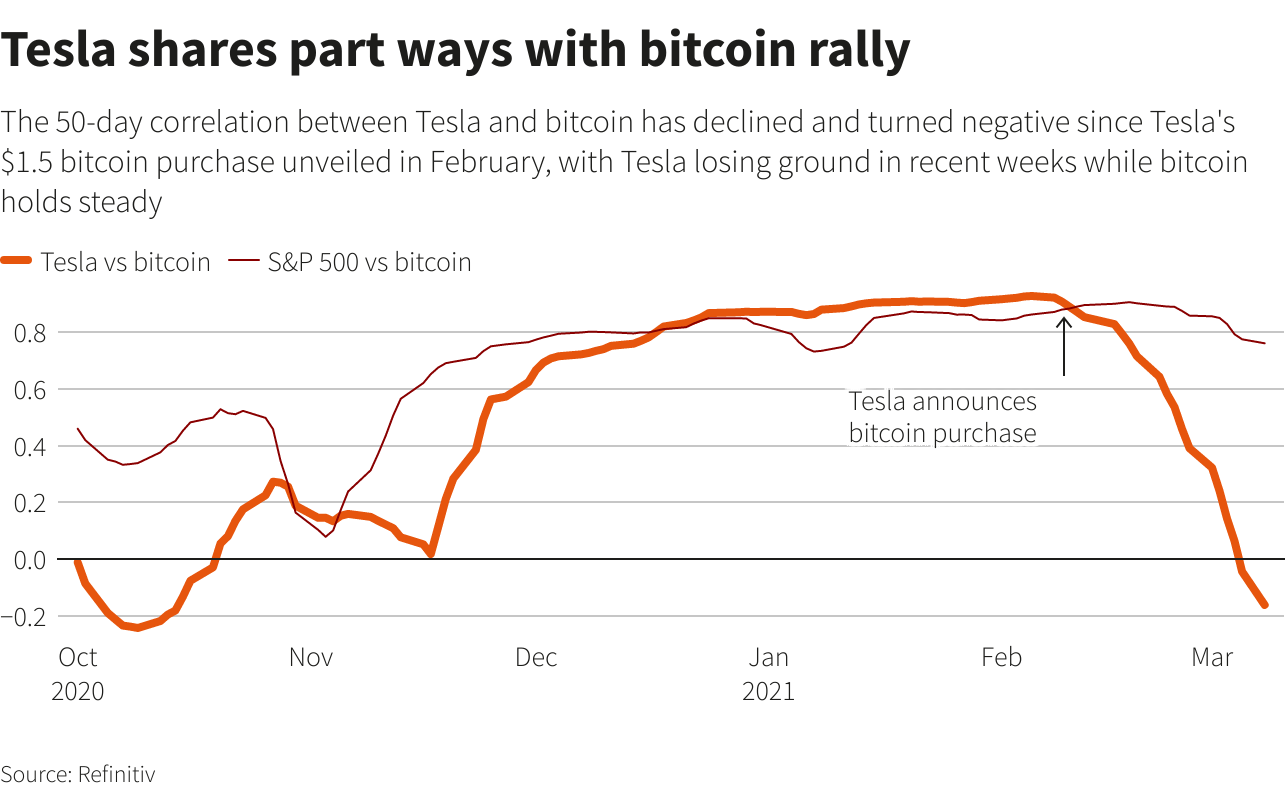

Last month, Tesla revealed it had purchased $1.5 billion of bitcoin and would soon accept it as a form of payment for cars, sending the price of the world’s most popular cryptocurrency soaring

(Subscribe to our Today’s Cache newsletter for a quick snapshot of top 5 tech stories. Click here to subscribe for free.)

Tesla Inc added “Technoking of Tesla” to billionaire Chief Executive Elon Musk’s list of official titles on Monday in a formal regulatory filing that also named finance chief Zachary Kirkhorn “Master of Coin”.

The electric-car maker did not elaborate on the reasons for the cryptic new titles in a pair of statements that also said President of Automotive Jerome Guillen had moved to the role of President for Tesla Heavy Trucking, effective March 11.

Also Read | Elon Musk wants clean power, but Tesla’s carrying bitcoin’s dirty baggage

Last month, Tesla revealed it had purchased $1.5 billion of bitcoin and would soon accept it as a form of payment for cars, sending the price of the world’s most popular cryptocurrency soaring.

Musk’s recent promotion of dogecoin on Twitter has also lifted the price of that cryptocurrency.

Bitcoin hit new highs of near $62,000 over the weekend but retreated around 5% early in the European day on Monday.

[ad_2]