Tesla share price: Tesla surges almost 20%, biggest daily rise in a year | International Business News – Times of India

[ad_1]

Read More/Less

NEW DELHI: Shares of electric vehicle maker Tesla Inc surged nearly 20% on Tuesday, rebounding from a deep selloff with its largest daily gain in a year after data showed an increase in China sales and an analyst raised his rating on the stock.

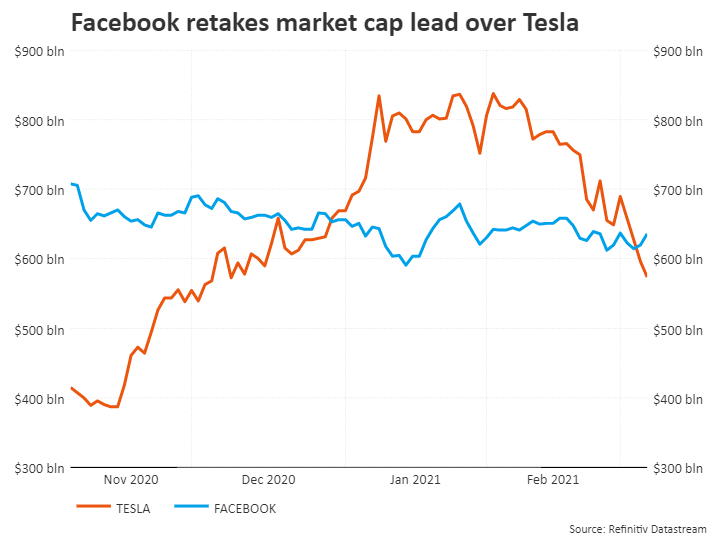

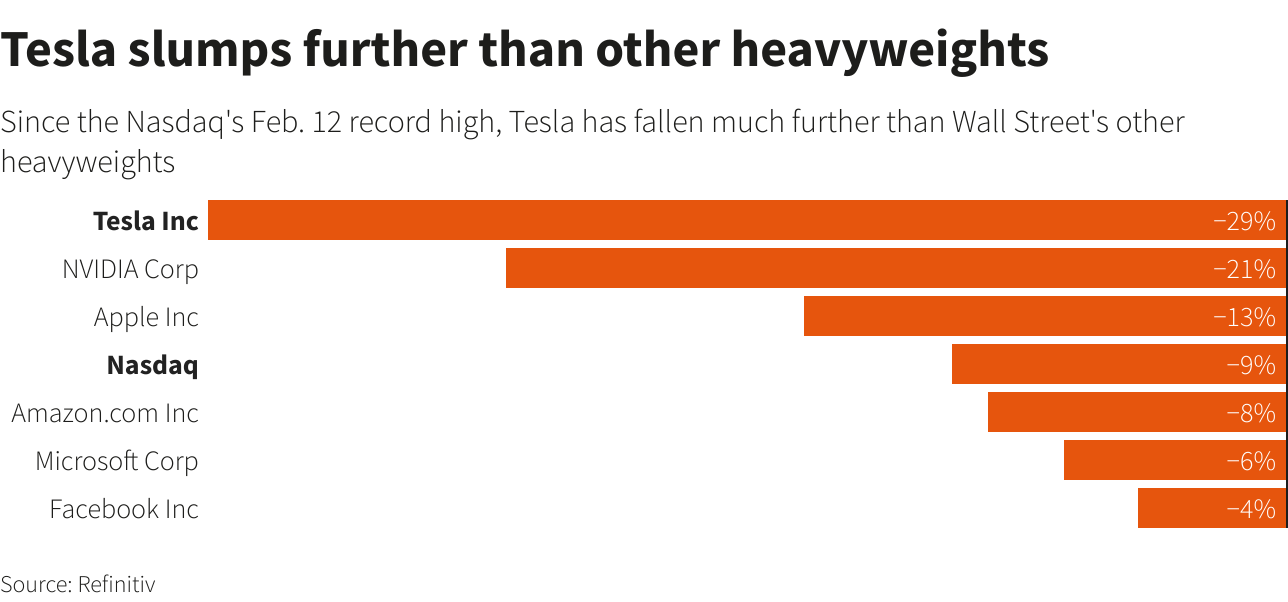

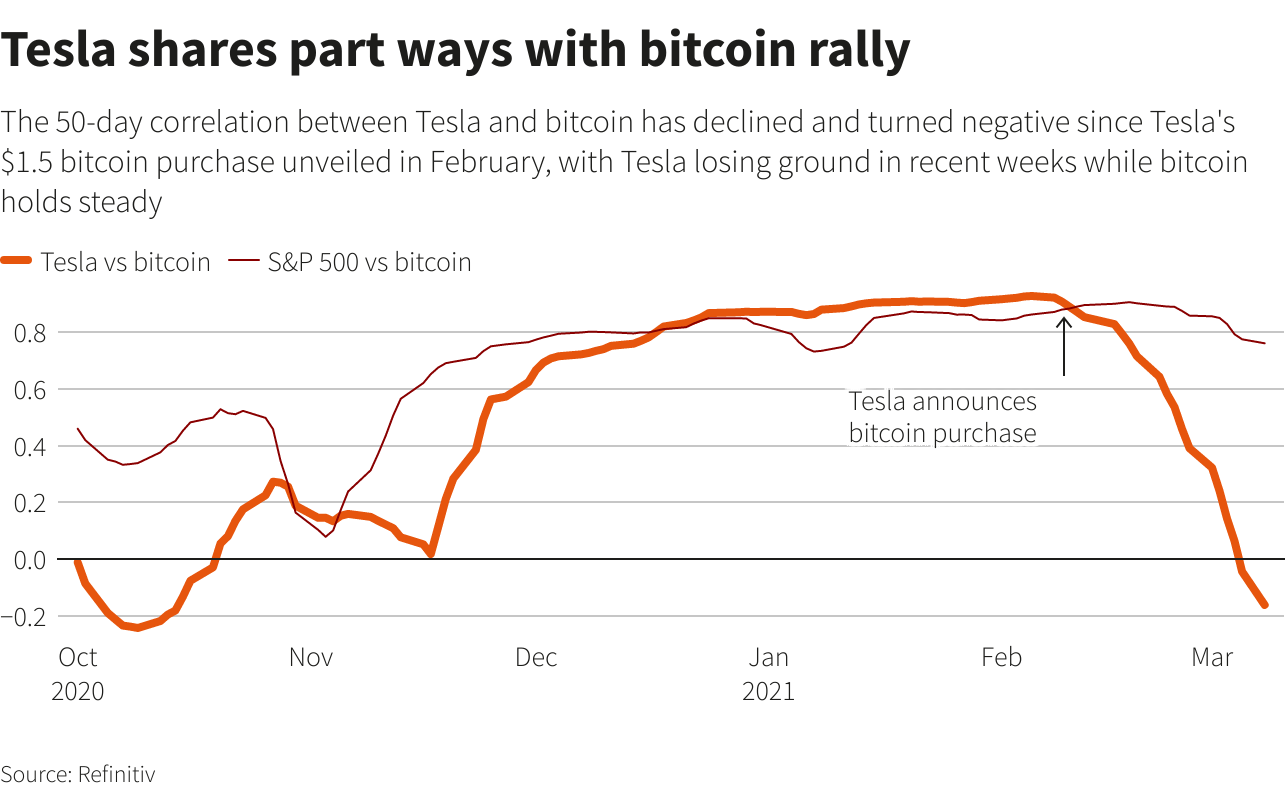

The jump, which added over $100 billion to Tesla’s market capitalisation, stopped a five-day streak of losses for the company in a Nasdaq slump in which investors spooked by rising interest rates have abandoned growth stocks with heady valuations.

New Street Research analyst Pierre Ferragu raised his Tesla rating to “buy” from “neutral,” and upped his target price to $900 from $578.

Tesla’s stock ended at $673.58 after its strongest daily rise since February 2020. The stock remains down more than 20% from its January record high.

Traders exchanged nearly $43 billion worth of Tesla shares, more than any other stock and almost triple the second most-traded company, which was Apple, according to Refinitiv data.

“As much as the market severely corrected the recent excesses of optimism reflected in Tesla’s valuation, our recent work strengthened our confidence about the solid outlook for the company in the next two years,” Ferragu wrote in a client note.

Tesla sold 18,318 China-made vehicles in February, up from 15,484 in January, Chinese auto industry body CPCA said.

Cathie Wood, whose $25 billion ARK Innovation exchange-traded fund is the largest actively managed ETF tracked by Lipper, said on a webcast that she saw the recent stock market selloff as a buying opportunity, the Financial Times reported.

Tesla is the largest holding of ARK Innovation, which is popular with retail investors. The ARK Innovation fund was up 10% on Tuesday.

Tesla’s stock remains up about 70% over the past six months. Thirteen analysts have neutral ratings on Tesla, while 12 recommend buying and 10 recommend selling, according to Refinitiv.

Tuesday’s Tesla rally accompanied a 3.7% jump in the Nasdaq, as US bond yields retreated and investors picked up battered technology stocks. Tesla was the biggest contributor to the 1.4% gain in the S&P 500, which it joined in December.

[ad_2]